Solar Tax Credit

Northern Lights Solar designs solar heating systems that are SRCC certified and qualify for the US 22% Tax credit program until 2015. In 2016 this program was extended to the year 2021 for residential solar projects and longer for commercial. The SRCC rated Sun Rain Collectors are included in the list of OG-100 acceptable collectors. In order to qualify for the Tax credit, you must complete IRS form 5695 when filing your taxes. The credit covers both the parts and any associated labour cost with installing your solar heating system.

What does the federal solar tax credit extension mean for the solar industry?

The federal ITC was originally established by the Energy Policy Act of 2005 and was set to expire at the end of 2007. A series of extensions pushed the expiration date back to the end of 2016, but experts believed that an additional five-year extension would bring the solar industry to its full maturity. Thanks to the spending bill that Congress passed in late December 2015, the tax credit is now available to homeowners in some form through 2021. Here are the specifics:

-

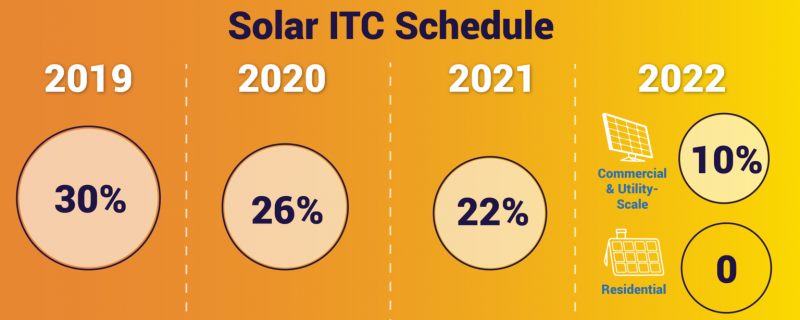

2016 – 2019: The tax credit remains at 30 percent of the cost of the system. This means you can still get a major discount off the price for your solar panel system.

-

2020: Owners of new residential and commercial solar can deduct 26 percent of the cost of the system from their taxes.

-

2021: Owners of new residential and commercial solar can deduct 22 percent of the cost of the system from their taxes.

-

2022 onwards: Owners of new commercial solar energy systems can deduct 10 percent of the cost of the system.

The current subsidies make it a great time to install a solar water heating package.